Investors shouldn’t get complacent about inflation: we may not see an early return to historic levels, but conditions are ripe for an unexpected rise. To fight the erosion of their purchasing power, investors should consider real assets – such as commodities and real estate – as well as equities and inflation-linked bonds.

Key takeaways

- Inflation may be temporarily gone, but it should not be forgotten: oil prices, currency volatility and trade wars could force up inflation unexpectedly

- The combination of inflationary factors and disinflationary structural forces – ageing demographics, a shrinking workforce – raises the risk of a policy error by central banks

- When central banks see inflation, they will likely celebrate it rather than try to quash it like they did decades ago

- Rather than debate what inflation’s true level is, or why it hasn’t reverted to historical norms, investors should question their own inflation complacency

Working against inflation are certain disinflationary structural forces – such as ageing demographics and a shrinking global workforce – that show no signs of abating. Increased competition and the rise of the digital economy are also making it more difficult for companies to raise prices. These are worrisome developments that raise the risk of a policy error by central banks as they attempt to meet their inflation mandates.

Why inflation could move higher

Even though inflation may be temporarily gone, it should not be forgotten. We believe there are a range of reasons to expect that inflation could move higher unexpectedly:

- The price of oil appears likely to continue hovering near USD 75 per barrel, which could be inflationary. An oil shock from the Middle East could drive prices up even more.

- Diverging monetary policy among major central banks is causing currency-market volatility. For trade-reliant countries, weaker currencies mean import inflation, which can undermine real consumer spending and investment.

- As China reforms its state-owned enterprises and the country begins exporting for profit rather than employment, higher traded-goods prices could help exporters but hurt consumers.

- Trade wars will hopefully be short-lived, but friction between the US and China or others is likely to deliver a small increase to global inflation.

- Asset prices have been boosted by “cheap” money and plenty of leverage, but the real-estate market could also cause problems if purchase and rental prices keep rising, consumer spending falls and economic inequality grows worse.

- Businesses are faced with rising input costs from higher wages and increasingly expensive raw materials. Eventually, they may be forced to choose between lifting prices and reducing their margins.

Central banks are taking different approaches to inflation

The global economy made its way out of the 2007-2008 financial crisis by using record-low interest rates to pile on debt. A great deleveraging is overdue, yet much of the world’s debt may not be reduced by the usual measures – repayment or default – but instead repaid with “default by inflation”.

In this sense, central banks will likely celebrate inflation rather than try to quash it like they did decades ago. But since each economy faces a different set of threats and opportunities, investors should expect a variety of approaches from central banks managing diverging economies:

- United States. The already strong economy could get even hotter thanks to aggressive fiscal stimulus in the form of President Donald Trump’s tax reforms. This could overly tighten labour markets and cause a boom-then-bust cycle, revealing a Federal Reserve that hasn’t raised rates quickly enough to keep up with inflation. Watch for the US dollar to move higher, and for a greater risk of higher wages, falling corporate margins and supply bottlenecks.

- United Kingdom. With the UK mired in Brexit, the weakness of the British pound has pushed up domestic inflation – and with 60% of consumption coming from imports, the UK is vulnerable to more inflation shocks as Brexit unfolds. This could squeeze real consumer spending and GDP growth.

- Europe. Excess production capacity, high unemployment and a strong euro have kept inflationary pressures low, and we don’t expect this to change even if Italy and France kick-start their economies.

- China. Inflationary pressures have been modest as commodity prices stabilise and reforms in coal, power and steel work their way through the economy. Food prices are a political concern but have been contained for now, while a higher producer price index is supporting corporate profitability.

- Japan. Japan remains mired in a modestly deflationary environment as the ageing of its society continues. Any changes to the Bank of Japan’s policy could leave the yen stronger and further contain inflation, even with higher oil and power prices.

- Emerging markets. The inflationary outlook for Asia and other emerging-market nations is benign. However, a rising US dollar and higher oil prices may again constrain consumer spending and some corporate pricing power.

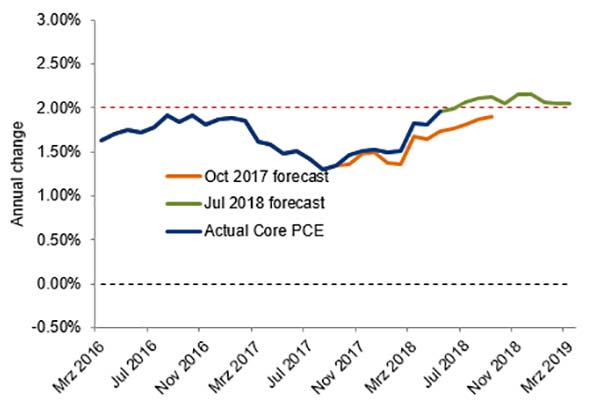

Core inflation may rise above the Fed’s 2% goal

Core PCE forecasts (2016 to 2019)

Source: US Bureau of Economic Analysis; Allianz Global Investors calculations Data as at 25/7/2018.

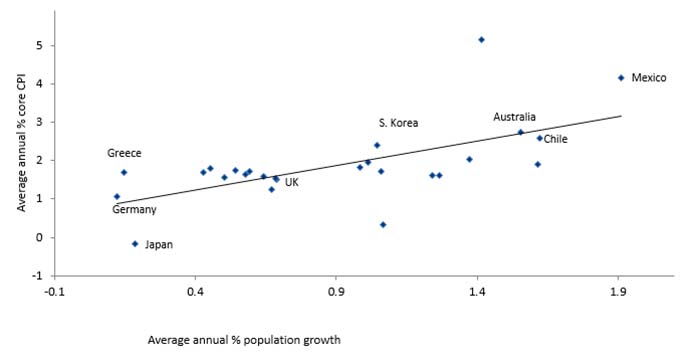

A strong link between low population growth and low inflation

OECD countries excluding Eastern Europe (2000 to 2016)

Source: Organisation for Economic Co-operation and Development. Data as at 31/12/2016. RSquared = 0.27.

What investors can do to fight inflation

Given the relative lack of inflation in recent years, too many investors may be neglecting to protect their portfolios. This is a mistake, given that even relatively low levels of inflation can significantly erode purchasing power over time.

To combat inflation, consider real assets like commodities and real estate, which have traditionally held their real value better than financial assets like bonds and cash:

- While property has always been a good hedge, it is expensive in many regions, reducing its usefulness unless held for many years.

- Infrastructure assets often provide the potential for attractive long-term returns, and they help institutional investors match long-term liabilities with long-term liabilities – albeit with now lower levels of yield.

- Gold can be a hedge against both inflation and policy errors by central banks.

Aside from real assets, the two most common hedges against inflation are inflation-linked bonds (ILBs) and equities – though equities, like property, can be too volatile to be an effective inflation hedge in the short term.:

- ILBs are markedly less liquid than many other fixed-income securities, and they can be expensive because large institutional investors buy and hold them to match their long-term liabilities.

- What makes ILBs attractive is that they adjust for changing levels of inflation, offer much lower volatility and can provide a well-diversified global opportunity set – qualities that are particularly useful given the inability of many traditional fixed-income investments today to offer significant real returns.

Protecting purchasing power is paramount

Despite the debate about what inflation’s true level is, or why it hasn’t reverted to its historical norms, we believe the more important issue is investors who suffer from inflation complacency. Investors should aim to grow their wealth with the appropriate level of risk in a manner that protects their purchasing power against the longer-term threat of inflation – even at 2% levels. Sir John Templeton, one of history’s best-known investors, said it best:

“Invest for maximum total real return. This means the return on invested dollars after taxes and after inflation. This is the only rational objective for most long-term investors. Any investment strategy that fails to recognize the insidious effect of taxes and inflation fails to recognize the true nature of the investment environment and thus is severely handicapped.”