Matthew Chaldecott, Fixed Income Product Specialist, discusses how to target the ideal portfolio mix in the current credit environment.

As we near the end of 2018, we have finally started moving away from accommodative monetary policy globally. This has profound implications for credit as well as government bonds; as such we advocate increased selectivity and diversification. In particular, there are ‘sweet spots’ of credit quality and interest rate exposure that should deliver optimal risk-adjusted returns. The US Federal Reserve has hiked rates several times and has started its balance sheet runoff, while the European Central Bank is also set to taper its purchases. Additionally the Bank of England has raised rates, and further rises may be on the horizon.

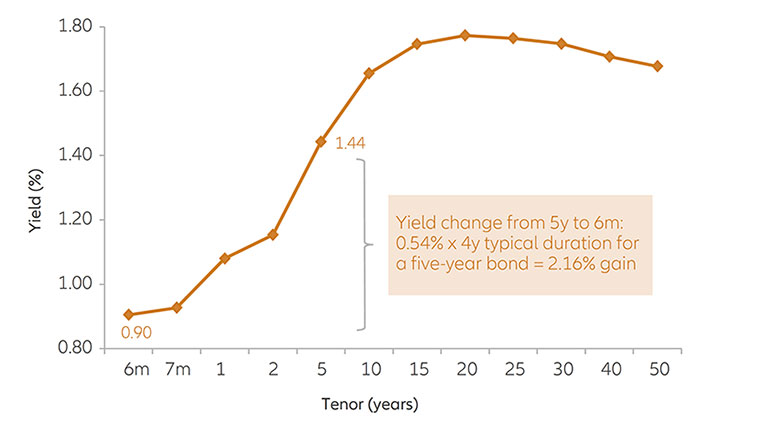

No central bank wishes to tighten policy too aggressively and any unwind of quantitative easing should be gradual. Combined with decent growth, the environment for credit is benign, particularly at the short end where rate hikes are priced in. There is thus a benefit from taking moderate interest rate risk, as bonds ‘roll-down’ from higher long yields to lower short yields . The ‘sweet spot’ is currently found under five years’ maturity (see chart below).

Illustrating ‘roll down’: Sterling swaps curve September 2018

Source: Bloomberg, 30th September 2018.

While we are at a potential inflection point in interest rates, in credit we see late stage behaviour. This can be partly attributed to management’s motivation to minimise their cost of capital. Academic studies1estimate that it is minimised around 55% debt, depending on the industry. In credit terms, this is around a BBB- rating. Companies with low leverage will tend to increase debt, while others with more debt will want to improve their balance sheets. For investors, there is a premium available from ‘rising stars’ who reach investment grade, while companies above the crossover point should drift lower but not below. We believe the second ‘sweet spot’ is therefore around BBB/BB.

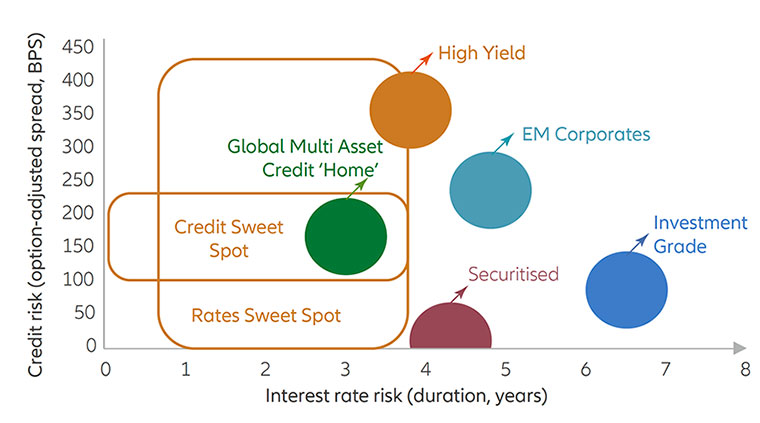

Combining these two parameters suggests an ideal portfolio of sub-five years’ duration and BBB/BB credit quality. Certainly it is sometimes prudent to run more or less interest rate or credit risk, and there are diverging cycles by geography and sector. This points towards a flexible global approach, one we employ in our Global Multi Asset Credit Fund (see chart below).

Global multi asset credit: illustrative risk exposure

Source: Allianz Global Investors, Bloomberg, September 2018.

Targeting a base of lower duration than investment grade, and less credit risk than high yield or emerging markets, while allowing latitude to move between asset classes, has served the strategy well, producing a Sharpe ratio of 1.32. In the later stages of a credit cycle, different sectors and credit profiles can perform very differently, thus a credit picking approach, rather than following a benchmark, should provide superior outcomes.

1 Source: Brealey, Richard A. and Myers, Stewart C. (2003). Principles of Corporate Finance, Standard & Poor’s, Allianz Global Investors.

2 Source: Allianz Global Investors, based on monthly gross returns in GBP from June 2014 to September 2018. For professional investors only.